Tax Updates

This time of year is common for the start of the release of tax changes and remedial updates. Here is a snapshot of the latest changes.

Employment Law changes (Effective 1 April 2023)

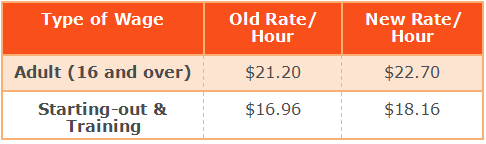

The minimum wage rates are set to increase:

Cost of Living Support

The Cost of Living support relating to the reductions in fuel excise duty and road user charges, as well as public transport fares has been extended to 30 June 2023.

Tenancy Compliance (Effective 26 November 2022)

The healthy homes compliance timeframes to meet the standards has been extended from 90 days to 120 days and the final date by which all private landlords must comply has been extended from 1 July 2024 to 1 July 2025.

Family Tax and Best Start Credits (Effective 1 April 2023)

Family tax credit rates increase for the eldest child from $6,642 to $7,121 and the subsequent child rate increases from $5,412 to $5,802.

Best Start tax credit increases from $3,388 to $3,632.

Minimum Family tax credit increases from $32,864 to $34,216.

GST Changes (Effective 1 April 2023)

We included in the December 2022 newsletter the upcoming GST changes. You will notice changes within your electronic system as these changes roll out. You will also see increased publications from the Inland Revenue Department in this regard. If you are unsure please contact your Accounting Specialist.