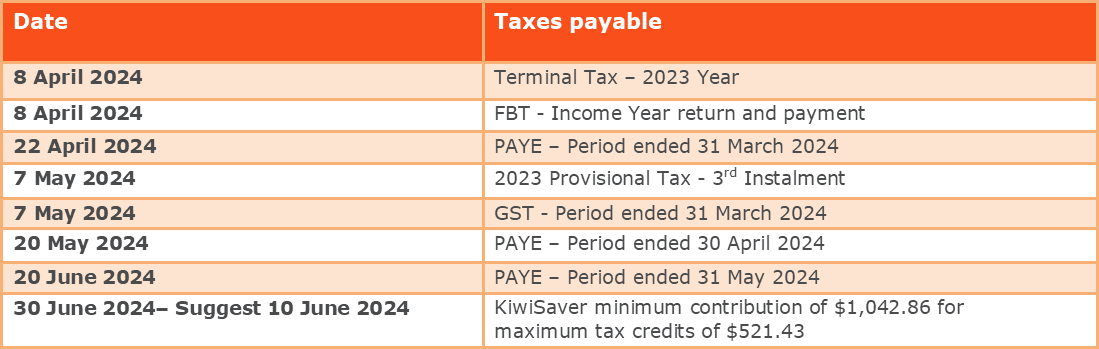

Key Tax Dates

Terminal Tax notices (Payable 8 April 2024) – We will print and release these notices in the last week of March 2024.

Provisional Tax notices (Payable 7 May 2024) – We will print and release these notices in the last week of April 2024.

Provisional Tax review – Prior to the 3rd instalment of Provisional Tax falling due, we are able to undertake a review of your last 12 months of trading to consider if your tax payment can, or should be adjusted either upwards or downwards so it is more in line with what we expect the actual tax to be, especially if there is significant changes to the 2024 trading year. Once the GST Return is completed for the February/March 2024 period we can obtain the appropriate information from your GST records. If you are scheduled for a Provisional Tax review, you will receive an invitation in early April. If you would like a review done and you do not receive an invite, then please contact us with urgency prior to the 15th April 2024.

Kiwisaver - To be eligible for the full member tax credit of $521.43 you have to contribute at least $1,042.86 a year. The Government will contribute 50 cents for every dollar of member contribution annually. If you have not yet contributed the minimum amount, we suggest that you arrange a voluntary contribution prior to the beginning of June 2024 to ensure time for your credits to be transferred to your KiwiSaver fund by the due date of 30 June 2024. Payments can be made in two ways; either directly to your scheme provider or to the IRD by choosing the "Pay tax" option and including your IRD number, the tax type "KSS", and recording the period "0" (zero) or by any other means of paying taxes.