Goods And Services Tax (GST)

If you are registered for GST and if relevant, you may have recently received two lots of communication which has been directly released by the IRD.

The first being around carrying on a taxable activity and being registered for GST. This communication was released in November 2022 and would have been applicable to tax payers that consistently file nil GST Returns, suggesting that you no longer carry on a taxable activity. The communication advised that the IRD intended to cease the GST registration. For a taxable activity, there are 4 requirements that must be satisfied which include the activity being continuous or regular and involve either the supply or intention to supply goods or services for money or other reward. If you have ceased your taxable activity and your GST registration is no longer required then please do talk to us first. There are a number of matters we need to consider to ensure we get the correct tax outcome and timing of the change. For example, just because you have ceased your taxable activity, if you continue to hold assets or the like where input tax has been claimed, then we need to consider a change in use and adjust by way of an output tax adjustment.

The second being the upcoming changes in GST invoicing and record keeping. The majority of these take place from 1 April 2023 and include changes to terminology, rules and documentation requirements.

From 30 March 2022, changes to expense claims and buyer-created tax invoices came into play to simplify. Previously, you needed to keep a tax invoice to claim GST on any supplies costing more than $50 (including GST) you bought for your taxable activity. While you must still keep records to support your expense claims, including a tax invoice if you receive one, you can now keep other records that are sufficient on their own, or in combination to support your expense claims. For example, invoices, supplier agreements, contracts and bank statements. Sellers still need to produce tax invoices when they sell goods and services for more than $50 (including GST) until 31 March 2023. Previously, if you wanted to issue buyer-created tax invoices, you needed to get Inland Revenue's approval beforehand Approval is now no longer required and GST registered buyers and sellers can just enter into an agreement to use buyer-created tax invoices (criteria applies).

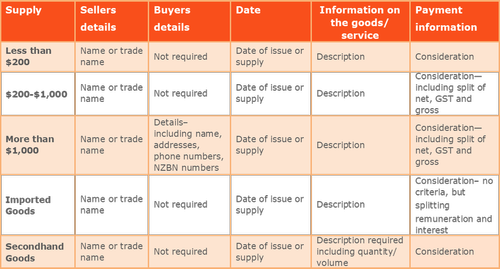

From 1 April 2023, further changes are introduced to simplify record keeping. A new term ‘taxable supply information’ will replace ‘tax invoices’ and ‘supply correction information’ will replace Debit/Credit notes. If you use an electronic cashbook such as Xero, we expect that this will automatically update. There will also be certain record keeping requirements for supply less than $200, $200 - $1,000, more than $1,000, imported goods and secondhand goods – summary below of what is required:

Taxable supply information must be provided to GST registered buyers within 28 days of a request for the taxable supply information (or by an alternative date agreed to by the parties) for supplies over $200. For supplies of $200 or less, sellers are required to keep a record of the supply, but they are not required to provide taxable supply information. Supply correction information must be provided when the taxable supply information included an incorrect amount of GST, or when the seller has included an incorrect GST amount in their GST Return and there is specific information required on this form.

Our preference is that you continue to hold a supporting document for all business related transactions. This will help us when preparing your year end work.